how do i pay my personal property tax in richmond va

Include your Social Security number and the tax period for the payment on the check. On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding.

Access City of Virginia Official Website.

. Is more than 50 of. 295 with a minimum of 100. Prorate of personal property tax began January 1 1991 on all vehicles with the exception of.

The county also can. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Homeowners in the state of Virginia pay property tax rates that are well below the national.

Make tax due estimated tax and extension payments. Pay Your Bill Chesterfield County levies a tax each calendar year on personal property with situs in the county. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

Personal property taxes on automobiles trucks motorcycles low speed. Pay all business taxes. Pay bills or set up a payment plan for all individual and business taxes.

Owners of property except for owners of public service business property who wish to protest the assessed value of their property must file a protest with their county commission sitting as a. On the first screen enter your email address and then press OK button. Attach check or money order payable to Virginia Department of Taxation.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Personal Loan Rates. Real Estate and Personal Property Taxes Online Payment.

Electronic Check ACHEFT 095. The current percentage reduction for personal property tax relief is 459 for the 2022 tax year. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. Selecting options for consulting taxes. How do I pay my personal property tax in Richmond VA.

1 View Download Print and Pay Richmond VA City Property Tax Bills.

Alameda County Ca Property Tax Calculator Smartasset

How School Funding S Reliance On Property Taxes Fails Children Npr

Property Taxes How Much Are They In Different States Across The Us

Henrico County Personal Property Tax Bills Due Friday Wric Abc 8news

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Pay Online Chesterfield County Va

The Hidden Costs Of Owning A Home

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Population Wealth And Property Taxes The Impact On School Funding

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Population Wealth And Property Taxes The Impact On School Funding

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

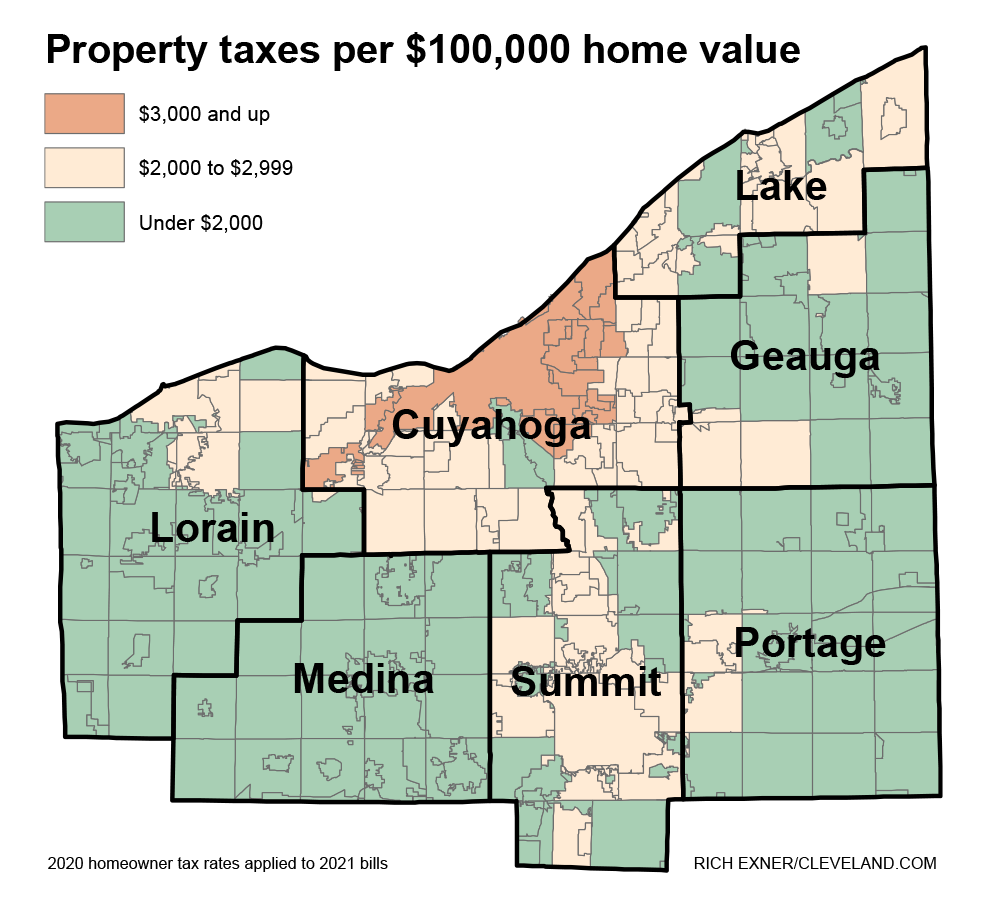

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Richmond Property Tax 2021 Calculator Rates Wowa Ca