hayward ca sales tax rate 2019

One of a suite of free online calculators provided by the team at iCalculator. The County sales tax rate is.

Is Shipping In California Taxable Taxjar

The California sales tax rate is currently.

. Average Sales Tax With Local. Most accurate 2021 crime rates for Hayward CA. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

Key features of this 2019 Cadillac CTS Luxury in Hayward CA. 4 rows Hayward. Historical Tax Rates in California Cities Counties.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The Hayward sales tax rate is. There are a total of 475 local tax jurisdictions across the state collecting an average local tax of 2617.

The county sales tax rate is. Method to calculate Hayward sales tax in 2021. Tax title licensing fees dealer fees and any optional products like service contract andor extended warranty.

COUNTYWIDE-UNITARY CODE AREA 00-001 PAGE 1 COUNTYWIDE-UNITARY CODE AREA 00-002 9991 UNITARY OP-NONUNITARY 1 10000 9992 UNITARY OP-NONUNITARY 1 RR 10000. The Hayward California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Hayward California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Hayward California. The current total local sales tax rate in Hayward CA is.

City of san leandro 1075. For tax rates in other cities see California sales taxes by city and county. Datsun 620 - Classifieds.

6 rows The Hayward California sales tax is 975 consisting of 600 California state sales. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. This is the total of state county and city sales tax rates.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. CA Sales Tax Rate. The homeownership rate in hayward ca is 528 which is lower than the national average of 641.

This is the total of state county and city sales tax rates. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Hayward CA. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

The current total local sales tax rate in Carlsbad CA is 7750. The minimum combined 2022 sales tax rate for Hayward California is. City of san leandro 10.

For tax rates in other cities see California sales taxes by city and county. Nissan Datsun 620 Market. Between 2018 and 2019 the median property value increased from 519600 to 581200 a 119 increase.

The average sales tax rate in California is 8551. Tax rates are stated as a percentage of full value of taxable property. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Hayward CA.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Your chance of being a victim of violent crime in Hayward is 1 in 295 and property crime is 1 in 30. Total tax rate Property tax.

You can print a 975 sales tax table here. Click to see full answer. You can print a 975 sales tax table here.

CA Sales Tax Rate. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Look up the current sales and use tax rate by address.

Hayward ca sales tax rate 2019 Monday February 28 2022 Edit. Looking for classic cars muscle cars project cars or hot rods for sale. The minimum combined 2021 sales tax rate for hayward california is.

The December 2020 total local sales tax rate was also 7750. The alameda sales tax rate is. Hayward california measure nn hotel tax november 2020 hayward measure nn was on the ballot as a referral in hayward on november 3 2020.

2019 Cadillac CTS Luxury For Sale in Hayward CA 33955. The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward tax and 300 Special tax. Hereof what is the sales tax rate in California 2019.

The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward tax and 300 Special tax. Compare Hayward crime data to other cities states and neighborhoods in the US. The hayward california general sales tax rate is 6.

The county sales tax rate is. See how we can help improve your knowledge of Math. Home 2019 ca hayward rate.

We Have The Second Highest Sales Tax In The Country Where Is All This Money Going R Oakland

How To Use A California Car Sales Tax Calculator

California Sales Tax Rates By City

Wisconsin Sales Tax Rates By City County 2022

California Sales Tax Calculator

Alameda County California Sales Tax Rate 2021 Avalara

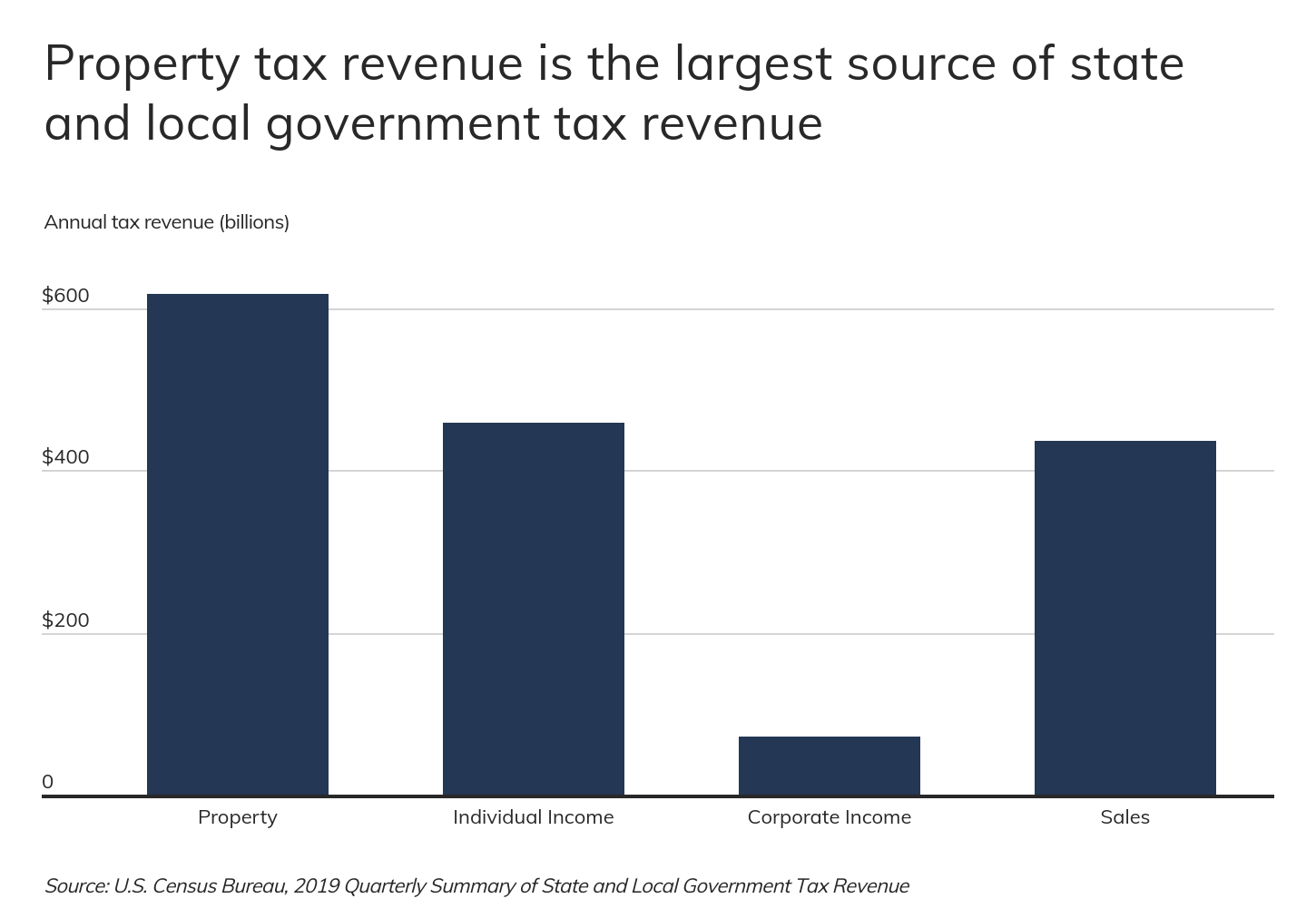

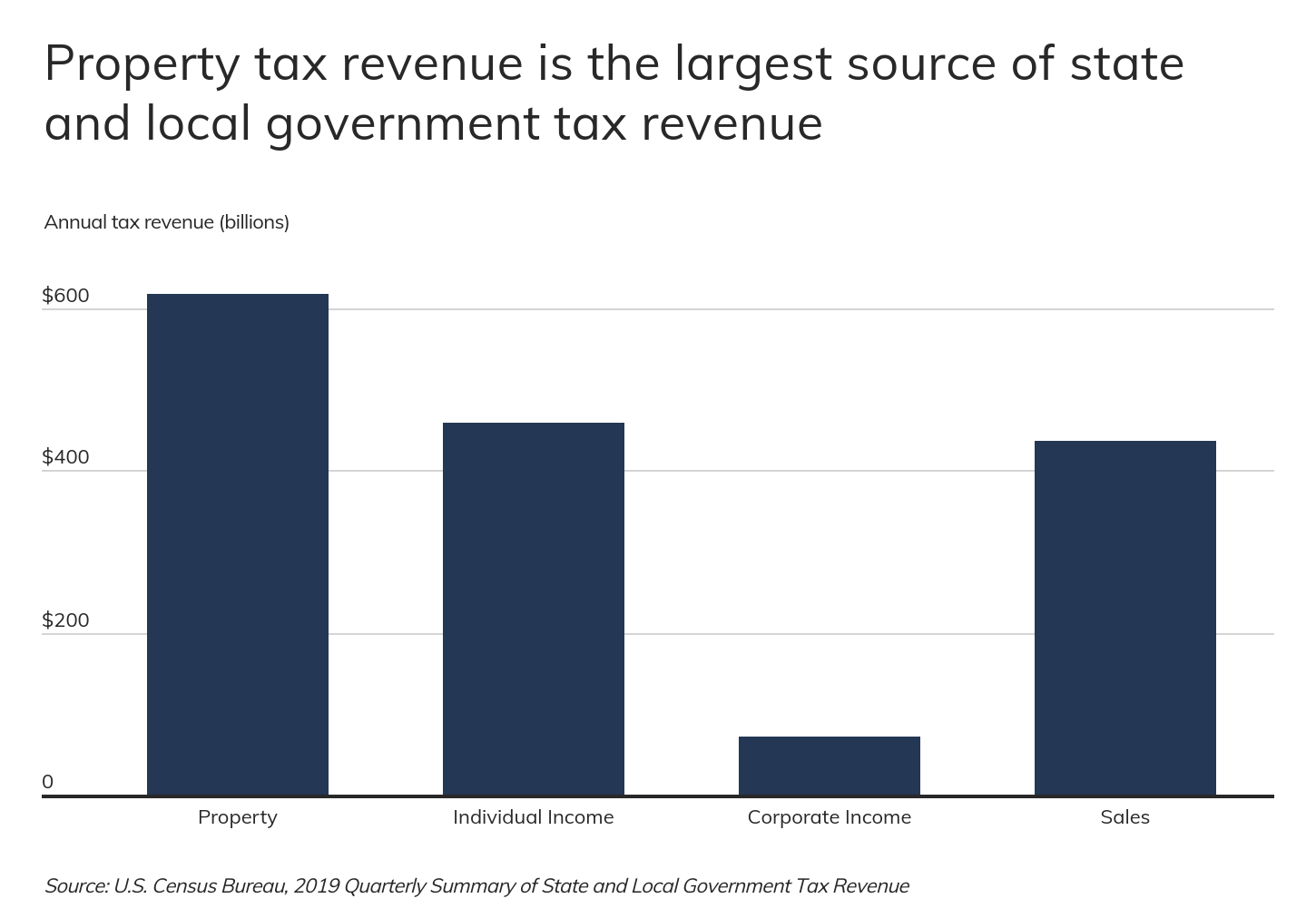

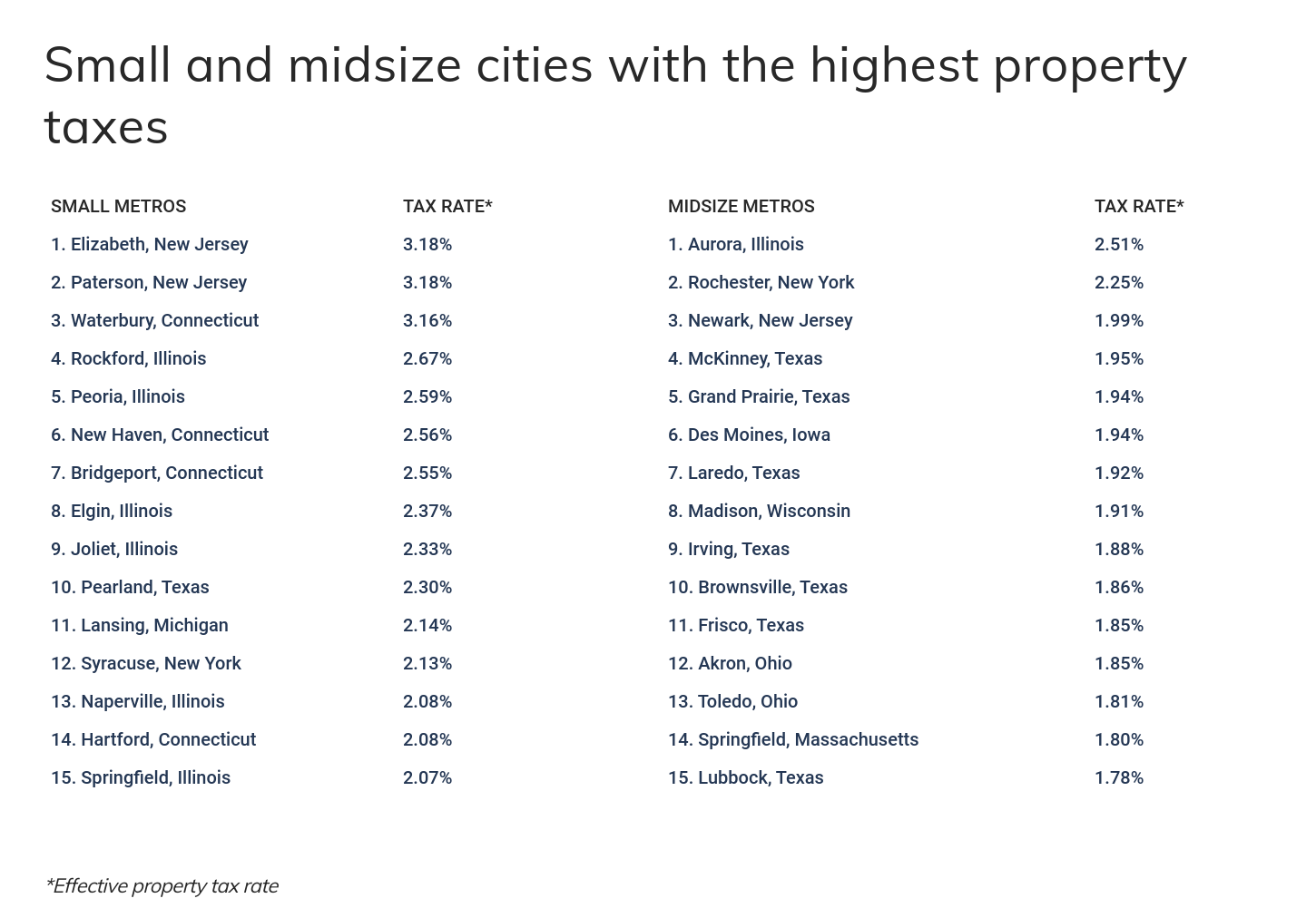

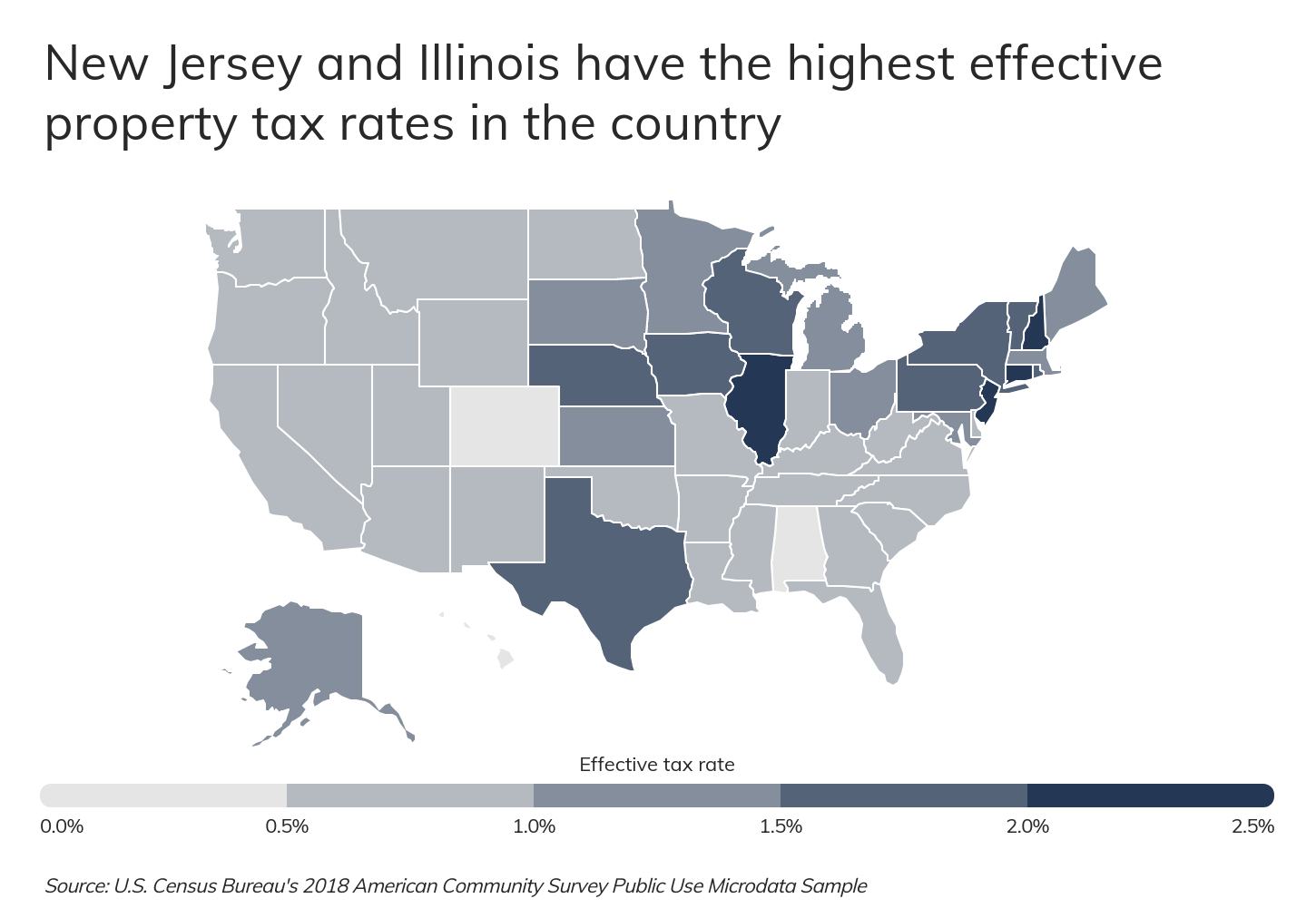

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

Why Is Sales Tax So High In California Quora

New Sales And Use Tax Rates In Hayward East Bay Effective April 1 Castro Valley Ca Patch

Would Lower Taxes Mean Increased Inflation Quora

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

Wisconsin Property Tax Calculator Smartasset

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com